What is a tax sale?

A very strong advantage of purchasing a property at tax sale is the ability to acquire a property at a price vastly below market value. Municipalities conducting tax sales need to recoup the amount of taxes plus penalties.

We will send weekly emails to our members with details about newly listed tax sales across Canada. We just started with Ontario, but we'll add more provinces later on. Our tenders search page will provide currently listed properties.

Members will have free access to information being sold in their chosen municipality. They will also have all the information needed to submit a tender and accurately complete the forms to ensure their tender is not rejected for technical reasons. This is completely free for members. Information about how to receive your information after the purchase is available in Frequently Asked Questions.

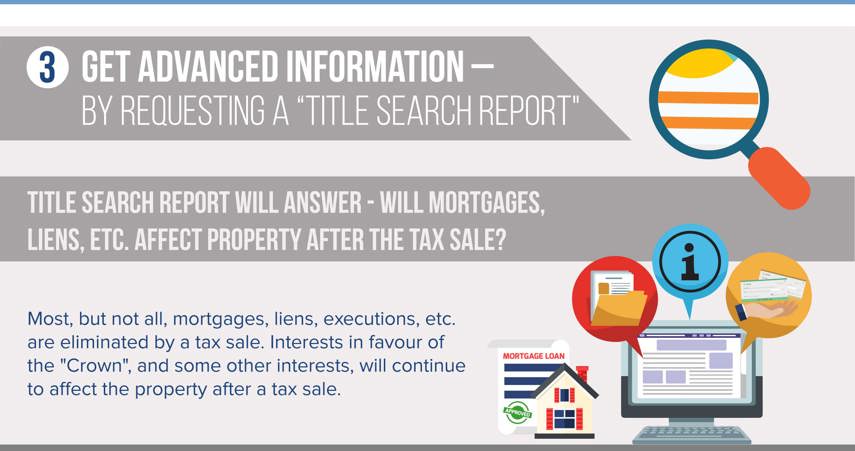

Nearly all mortgages, liens and executions are removed when a tax sale takes place. However, interests in favor of the Crown as well as certain other interests that run with the land will continue to affect a property after a tax sale.

In order to determine what interests will affect a property after a tax sale, you will need to obtain an up-to-date title search report and an execution search report. Members can order reports directly from our site. An in-house title report specialist will prepare a "Title Search Report" in simple easy to understand language. The Report will tell you if any encumbrances will remain against the property after the tax sale.

If you would like information about how you will receive your order after you purchase it, please visit FAQs page where we cover a lot of questions.

When you decide you would like to purchase a property, you need to submit a Tender.

A very strong advantage of purchasing a property at tax sale is the ability to acquire a property at a price vastly below market value. Municipalities conducting tax sales need to recoup the amount of taxes plus penalties.

Spring and fall are the busiest seasons for tax sales with winter being the slowest. Because tax sales are very time-consuming for municipalities, they generally engage in tax sales during periods of time when they are typically less busy.

Since the tax sale is a public event, others will likely be submitting tenders. The person with the highest tender will be permitted to purchase the property. Your deposit should be at least 20% of the full amount.