Purchasing a tax sale property without viewing it

It is possible the building may have been damaged, decayed or even destroyed in the intervening time. It is also quite possible that the photos don’t depict the property from significant angles.

Since the tax sale is a public event, others will likely be submitting tenders. The person with the highest tender will be permitted to purchase the property. If they choose not to do so, the second highest tenderer will be permitted to purchase the property. Noone else will be given the opportunity to make the purchase.

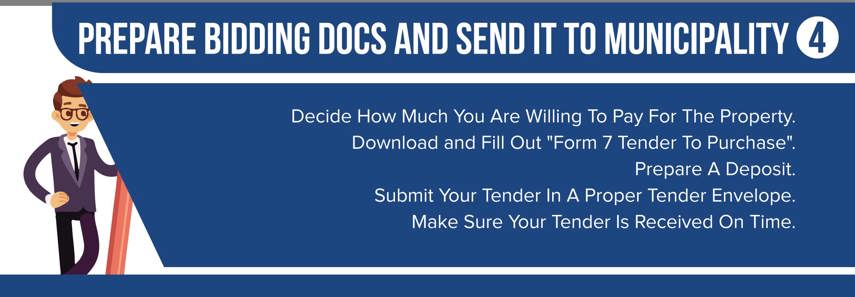

Form 7 - tender to purchase is the form that must be completed in order to make your tender offer. This form will include your name address and the amount you are willing to pay to make the purchase. You can find information for completing this form on our site. We can also provide instructions for those who wish to offer tender as a company or as multiple individuals. Form 7 should be available within tender documents package and completely free for our members. Please keep in mind that the form 7 pdf is interactive and you have to use Adobe Acrobat Reader to open it.

When you make your tender, it must be sent with a deposit of at least twenty percent of the total tender amount. As an example, if your tender offer is $100,000.00, you must send it with a deposit of $20,000.00 or more. Anything less than 20% will be rejected. Please also note that your deposit must be made by money order, bank draft or certified bank or trust corporation check.

If you are the prospective purchaser who submitted the highest tender, you will be permitted to purchase the property, but this means that you must pay the remaining balance plus the Land Transfer Tax and any additional property taxes or interest that are owed plus HST (if applicable) within 14 days of the tender date. If you don’t make full payment within the 14 days time period, you will lose your deposit and the right to purchase the property will go to the second highest Tenderer.

When you submit your Tender, it must be sealed in an envelope on which a description of the property must be written or an address for the land that is specific enough to allow the treasurer to identify the property for which you are tendering. Sometimes you will have a PDF file with the description of the tender and the treasurer and you can simply attach this to the envelope. The envelope must also say that it is for a tax sale. Tender envelope should be available in tender documents package.

Your tender must be received by the date and time indicated in the advertisement for the tax sale (visible on this site). If your tender is not received by that time, it will be rejected by the municipality.

While TSH would never advise someone not to use a lawyer, in nearly every tax sale we have been a part of, the buyer has purchased an up-to-date Title Search Report and submitted a tender on their own and then the municipality prepared the tax deed and registered title.

It is possible the building may have been damaged, decayed or even destroyed in the intervening time. It is also quite possible that the photos don’t depict the property from significant angles.

The municipality Treasurer will open the sealed Tender Envelopes in a place open to the public, as soon as possible after the last date and time for receiving tenders has passed.

When a tender is submitted for the purchase of a tax sale property, there must be absolute compliance with the Municipal Tax Sales Rules and the Municipal Act. There are many reasons a tender might be rejected.